GBP/JPY Price Analysis: Challeges to further recovery remain on the cards

- GBP/JPY remains mildly positive after two days of gains.

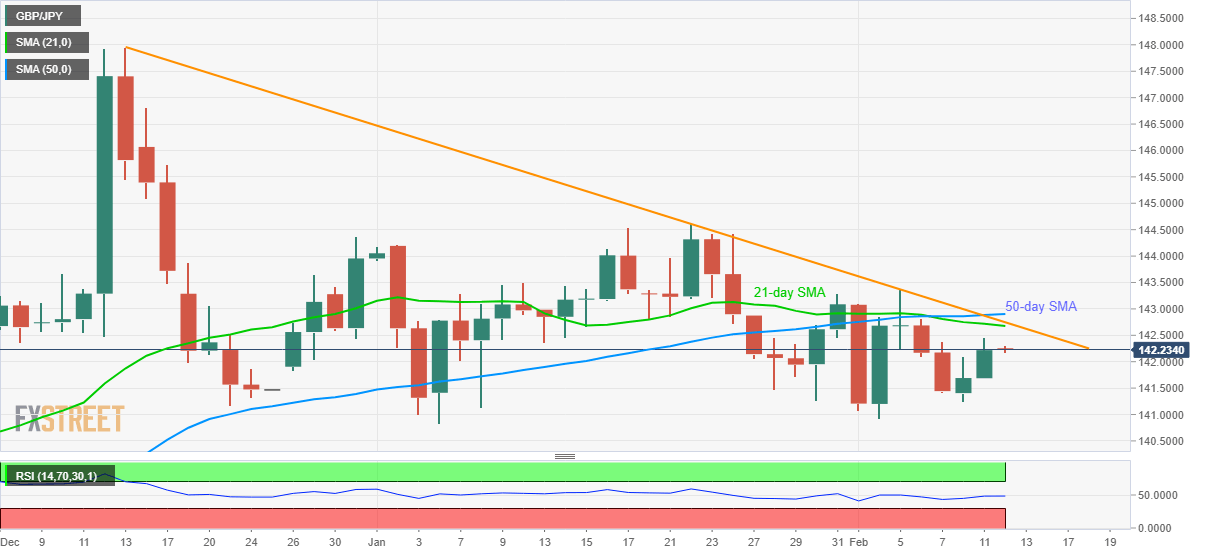

- 21-day and 50-day SMA join a two-month-old falling trend line to challenge the bulls.

- Lows marked in January-February limit immediate declines.

GBP/JPY holds the modest bid tone while flashing 142.23 mark during the early Asian session on Wednesday. In doing so, the pair remains positive after two days of gains. However, multiple key resistances stand tall to challenge the buyers.

21-day SMA around 142.67 acts as the first upside barrier, followed by a multi-day-old descending trend line from December 13, at 142.75, as well as 50-day SMA near 142.90, to check the pair’s recent recovery.

If at all the quote registers a daily closing beyond 142.90, it will need a sustained break beyond 143.00 round-figure to take aim at the yearly top surrounding 144.60.

Meanwhile, the weekly low near 144.20 can entertain short-term sellers ahead of pushing them to 140.93/82 area including bottoms marked in the current month and also in January.

It should, however, be noted that the quote’s declines below 140.82 may take a rest near 140.00 psychological magnet.

GBP/JPY daily chart

Trend: Pullback expected